Africa Development Indicators 2007: continent achieving healthy and steady growth rate

After years of stop-and-start results, many African economies appear to be growing at the fast and steady rates needed to put a dent on the region’s high poverty rate and attract global investment. The encouraging trend is shown in the World Bank Africa Development Indicators 2007 (ADI) [*.pdf] released today. The report is based on more than a thousand indicators covering economic, human and private-sector development, governance, environment, and aid.

After years of stop-and-start results, many African economies appear to be growing at the fast and steady rates needed to put a dent on the region’s high poverty rate and attract global investment. The encouraging trend is shown in the World Bank Africa Development Indicators 2007 (ADI) [*.pdf] released today. The report is based on more than a thousand indicators covering economic, human and private-sector development, governance, environment, and aid.Over the past decade, Africa has recorded an average growth rate of 5.4 percent which is at par with the rest of the world. The ability to support, sustain, and in fact diversify the sources of these growth indicators would be critical not only to Africa’s capacity to meet the MDGs [Millennium Development Goals on poverty, health and other issues], but also to becoming an exciting investment destination for global capital. - Obiageli Ezekwesili, World Bank Vice President for the Africa RegionSolid economic performance across Africa in the decade 1995-2005 contrasts sharply with the economic collapse of 1975-1985 and the stagnation experienced in 1985-95. The ADI indicates that spreading and sustaining growth going forward can be achieved by accelerating productivity and increasing private investment. Accomplishing this will require improving the business climate and infrastructure in African countries, as well as spurring innovation and building institutional capacity.

In 2005 [the latest year for which ADI 2007 posts data], the performance varied substantially across countries, from -2.2% in Zimbabwe to 30.8% in Equatorial Guinea, with nine countries posting growth rates of near or above the 7% threshold needed for sustained poverty reduction.

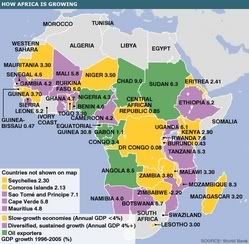

African countries fall into three broad categories along this continuum (map, click to enlarge):

- The first group of seven countries comprises the region’s seven major oil exporting economies, home to 27.7% of the region’s population.

- The second grouping of 18 countries, home to 35.6% of the region’s population, show diversified, sustained growth of at least 4%.

- The third grouping of 17 countries, home to 36.7% of the region’s population, is characterized by their resource-poor nature, their strong volatility, are conflict-prone, afflicted or emerging from conflicts or just trapped in slow growth of less than 4%.

Greater integration with the global economy especially through export trade, are characteristics common to all African countries that have recorded sustained growth. These according to the ADI largely explain the aggregate efficiency levels and investment volumes – comparable to India and Vietnam – recorded by these countries. Overall investments in Africa increased from 16.8% of GDP to 19.5% of GDP between 2000 and 2006.

Greater integration with the global economy especially through export trade, are characteristics common to all African countries that have recorded sustained growth. These according to the ADI largely explain the aggregate efficiency levels and investment volumes – comparable to India and Vietnam – recorded by these countries. Overall investments in Africa increased from 16.8% of GDP to 19.5% of GDP between 2000 and 2006.A revenue bonanza linked to skyrocketing oil prices especially helped Africa’s seven biggest oil economies. Rising prices of precious metals and other commodities have also benefited many other resource-rich African countries. Biopact and others think many large non-oil producing countries can now become bioenergy producers and exporters, driving a more diversified export growth.

In the high growth countries, ADI 2007 finds, policies have gotten better thanks to the reforms of the last decade, inflation, budget deficits, exchange rates and foreign debt repayments are more manageable; the economies are more open to trade and private enterprise; governance is on the mend and more assaults on corruption. These better economic fundamentals have helped to spur growth, but equally important to avoid the growth collapses that took place between 1975 and 1995.

The group of 18 resource-poor countries – home to 35.6 percent of Africa’s population – have done as well as some oil-rich countries, if not better, sustaining growth of more than 4 percent over the last decade:

energy :: sustainability :: biomass :: bioenergy :: biofuels :: petroleum :: agriculture :: commodities :: economic growth :: exports :: trade :: governance :: Africa ::

energy :: sustainability :: biomass :: bioenergy :: biofuels :: petroleum :: agriculture :: commodities :: economic growth :: exports :: trade :: governance :: Africa :: Only politically turbulent Zimbabwe among Africa’s 17 slowest-growing economies posted negative growth.

The slowest-growing economies – home to 36.7 percent of the region’s population – are getting more fundamentals right, ADI 2007 found. These include better macro-economic management, greater investments in human resource development, and improvements in institutions and in the performance of the public sector.

[Past pessimism about Africa’s ability to grow and compete with the rest of the world] does not arise from the failures of Africa enterprise and workers. [It] arises from the fact that the continent faces an infrastructure gap and a level of indirect costs that are anywhere from two to three times as high as those in competing economies in Asia. - John Page, World Bank Chief Economist for the Africa RegionWhile ADI 2007 reported significant long-term gains for Sub-Saharan economies, it warns that the region remains more volatile than in any other region. That volatility, it says, has dampened expectations and investments:

ADI 2007 finds that avoiding sharp declines in GDP growth was critical to Africa’s economic recovery. Indeed, it was crucial for the poor who suffered greatly during the declines. Avoiding growth collapses is key to accelerating progress towards the MDGs in Africa. - John PageMore exports needed

The report identifies stronger and more diverse export growth as a key factor needed to sustain growth and reduce volatility. The study laments the higher indirect costs of exporting in Africa (18% to 35% of total costs) compared to indirect costs in China – a mere 8% of total costs. As a result, while efficient African enterprises can compete with Indian and Chinese firms in terms of factory floor costs, they become less competitive due to higher indirect business costs, including infrastructure identified by ADI 2007 as an “important emerging constraint to future growth”.

Sub-Saharan Africa lags at least 20 percentage points behind the average for poor developing countries also funded by the World Bank’s concessional window (IDA) on almost all major infrastructure measures – pushing up production costs, a critical impediment for investors. Africa’s unmet infrastructure needs are estimated to total around $22 billion a year (5% of GDP), plus another $17 billion for operations and maintenance.

Despite the negative impact of poor infrastructure, 38 African countries increased their exports as the region as a whole saw its exports rise in value from $182 billion in 2004 to $230 billion in 2005. Exports were fuelled by growing pockets of non-traditional exports (such as clothing from Lesotho, Madagascar and Mauritius); the successful connection between farmers and buyers (such as with the initiative which boosted Rwanda’s coffee exports to the USA by 166% in 2005); and the aggressive expansion of successful exports (such as cut flowers whose exports from Kenya more than doubled between 2000 and 2005, making cut flowers the country’s second export earner, after tea).

Finding an appropriate balance between investments in human capital and investments in physical capital will help sustain steady progress towards the MDGs and closing Africa’s infrastructure needs, the report said. The infrastructure gap is estimated at $22 billion a year or 5 percent of the region’s GDP.

Besides infrastructure, accelerating and sustaining growth requires improving Africa’s investment climate, spurring innovation, and building institutional capacity to govern well, ADI 2007 said.

Drawn from the World Bank Africa Database, the ADI 2007 publication includes a pocket edition, the Little Data Book on Africa, the Africa Development Indicators 2007 – CD-ROM, and the new ADI family member, the Africa Development Indicators Online. ADI Online contains the most comprehensive database on Africa, covering more than 1,000 indicators on economics, human development, private sector development, governance, environment, and aid, with time series of many indicators going back to 1965. The indicators were assembled from a variety of sources to present a broad picture of development across Africa. ADI Online offers the ADI essay, the Little Data Book on Africa 2007, Country at-a-Glance tables, maps tools, technical boxes, and country analyses.

Map credit: World Bank, BBCNews.

References:

World Bank: Africa Development Indicators (ADI) 2007.

World Bank: Africa Achieving Healthy And Steady Growth Rate - November 14, 2007.

World Bank [press release]: Spreading and Sustaining Growth in Africa - November 14, 2007.

World Bank: 50 Factoids about Sub-Saharan African - Africa Development Indicators 2007.

World Bank: The Little Data Book on Africa 2007 [*.pdf] - quick reference guid for the ADI 2007.

--------------

--------------

Northern European countries launch the Nordic Bioenergy Project - "Opportunities and consequences of an expanding bio energy market in the Nordic countries" - with the aim to help coordinate bioenergy activities in the Nordic countries and improve the visibility of existing and future Nordic solutions in the complex field of bioenergy, energy security, competing uses of resources and land, regional development and environmental impacts. A wealth of data, analyses and cases will be presented on a new website -

Northern European countries launch the Nordic Bioenergy Project - "Opportunities and consequences of an expanding bio energy market in the Nordic countries" - with the aim to help coordinate bioenergy activities in the Nordic countries and improve the visibility of existing and future Nordic solutions in the complex field of bioenergy, energy security, competing uses of resources and land, regional development and environmental impacts. A wealth of data, analyses and cases will be presented on a new website -

0 Comments:

Post a Comment

Links to this post:

Create a Link

<< Home