Impact assessment of EU's 2020 biofuels target on agricultural markets

Earlier this year, the European Commission's Directorate-General for Agriculture and Rural Development published an impact assessment [*.pdf] of the 10 percent biofuel obligation by 2020 on agricultural markets. Its main conclusions: the targets can be achieved by second generation technologies and imports, grain prices would not increase in any substantial way, and agricultural markets are expected to remain stable over the long run. The Commission's projections are based on the assumption that 30% of the biofuels will come from second-generation fuels, whereas 20% would be imported.

Note that the report was published before the landmark International Biofuels Conference, where international trade and imports received more attention and backing (earlier post).

The Commission believes the biodiesel industry is very well developed and would continue its development over the next few years despite some recent readjustments of taxation of biofuels in some Member States. Increased availability of second generation Biomass-to-liquid (BLT) technology at an industrial scale is expected to boost developments in the biodiesel sector from 2014 onwards.

By 2013 the Commission expects an incorporation rate of 5.5 percent could be reached if Member States stringently aim at meeting the 10 percent objective in 2020. The impact on land use in the EU is expected to be relatively modest. Production from about 15 percent of arable land would be used. The total land used for first and second generation biofuel production would then be 17.5 million ha in 2020. Imports are expected to provide around 20 percent of the biofuel production:

energy :: sustainability :: ethanol :: cellulosic :: biodiesel :: biomass-to-liquids :: biofuels :: agriculture :: commodities :: land-use :: European Union ::

energy :: sustainability :: ethanol :: cellulosic :: biodiesel :: biomass-to-liquids :: biofuels :: agriculture :: commodities :: land-use :: European Union ::

Under the 10 percent obligation, about 59 million tons of cereals, or 18 percent of domestic use, is expected to be used as first-, and including straw, also as second-generation biofuels. Most of the cereals used would be soft wheat and corn.

The oilseed markets is expected to be affected more strongly, particularly the sunflower seed market which is expected to see significant increases of prices, up by 15 percent, because of the limited global production potential. The rapeseed prices are expected to be kept on moderate levels, up by 8-10 percent, by the developing production in Russia and the Ukraine. Soybean oil prices are expected to increase significantly due to the development of biodiesel industries around the world, mainly in Brazil and in the United States.

The Commission sees the bioenergy production as one of the major main stream opportunities for agriculture over the medium and long term. The analysis assumes a contribution of 30 percent of second generation biofuel in 2020.

The long term and relatively small increase in feed use expected in the EU over that time would leave enough possibilities for European farmers to support this new market outlet without a danger of returning to fertilizer and pesticide input patterns seen until the late 1980’s. Farm employment is also expected to decline less than without biofuels, and additional jobs are expected to be created in the downstream activities and processing of biofuel.

References:

European Commission, Directorate-General for Agriculture and Rural Development, Directorate G. Economic analysis, perspectives and evaluations, G.2. Economic analysis of EU agriculture: The impact of a minimum 10% obligation for biofuel use in the EU-27 in 2020 on agricultural markets - Impact assessment Renewable Energy Roadmap [*.pdf], March 2007

Biopact: Highlights from the International Conference on Biofuels (Day 1) -July 05, 2007

Biopact: Sweden calls for the creation of a 'biopact' with the South - Highlights from the International Conference on Biofuels (Day 1, part 2) - July 05, 2007

Biopact: How Brazil convinced the EU on biofuels - Lula's speech - July 06, 2007

Note that the report was published before the landmark International Biofuels Conference, where international trade and imports received more attention and backing (earlier post).

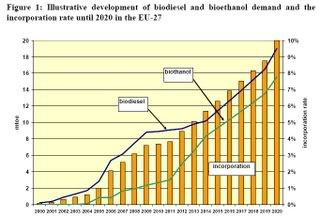

Development of biodiesel and ethanol demand and the incorporation rate until 2020 in the EU-27

According to analyses of DG Transport and Energy (TREN) the current biofuels directive (EC 2003/30) promoting 5.75 percent biofuel by 2010 would not reach the target, because the markets and technologies don’t have enough time to react. However, over the longer run achievement of 6.9 percent could be expected by 2020. The new biofuel legislation, which promotes 10 percent biofuel by 2020, would therefore increase biofuel demand by 3.1 percent and it would also lead to a more evenly spread consumption pattern across the EU.The Commission believes the biodiesel industry is very well developed and would continue its development over the next few years despite some recent readjustments of taxation of biofuels in some Member States. Increased availability of second generation Biomass-to-liquid (BLT) technology at an industrial scale is expected to boost developments in the biodiesel sector from 2014 onwards.

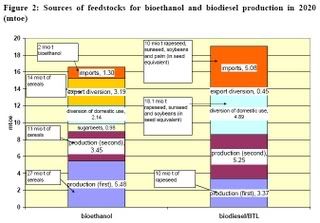

Feedstock composition for biodiesel and ethanol by 2020

The Commission expects a similar take off by second generation technologies in the bioethanol industry. However, the build up of first generation bioethanol capacities is expected to kick in from 2007 onwards and is assumed to gain pace from 2011-2013.By 2013 the Commission expects an incorporation rate of 5.5 percent could be reached if Member States stringently aim at meeting the 10 percent objective in 2020. The impact on land use in the EU is expected to be relatively modest. Production from about 15 percent of arable land would be used. The total land used for first and second generation biofuel production would then be 17.5 million ha in 2020. Imports are expected to provide around 20 percent of the biofuel production:

energy :: sustainability :: ethanol :: cellulosic :: biodiesel :: biomass-to-liquids :: biofuels :: agriculture :: commodities :: land-use :: European Union ::

energy :: sustainability :: ethanol :: cellulosic :: biodiesel :: biomass-to-liquids :: biofuels :: agriculture :: commodities :: land-use :: European Union :: Under the 10 percent obligation, about 59 million tons of cereals, or 18 percent of domestic use, is expected to be used as first-, and including straw, also as second-generation biofuels. Most of the cereals used would be soft wheat and corn.

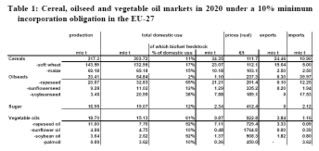

Grain, oilseed and vegetable oil markets in 2020 under the 10% target

The Commission expects that this would be provided by a yield increase of about 1 percent per year, which would lead to 38 million tons more cereals in 2020, and another 14 million tons could be grown on set aside land, if the set aside scheme lasts. Domestic use of cereals is expected to increase significantly while exports will decrease. Cereal prices would appear stable and reach €120/ton in real terms or €150/ton in nominal terms. The long run impact of biofuels on cereal prices is expected to be in the range of 3-6 percent as compared to 2006 prices. The second generation biofuel production would reach about a third of the domestic biofuels production, largely by incorporating the straw and wood based cellulosic material into production. About 1.75 million tons of oil equivalent (mtoe) wood based material is expected to be imported.The oilseed markets is expected to be affected more strongly, particularly the sunflower seed market which is expected to see significant increases of prices, up by 15 percent, because of the limited global production potential. The rapeseed prices are expected to be kept on moderate levels, up by 8-10 percent, by the developing production in Russia and the Ukraine. Soybean oil prices are expected to increase significantly due to the development of biodiesel industries around the world, mainly in Brazil and in the United States.

The Commission sees the bioenergy production as one of the major main stream opportunities for agriculture over the medium and long term. The analysis assumes a contribution of 30 percent of second generation biofuel in 2020.

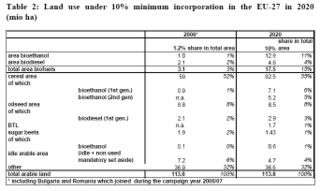

Land-use by 2020 under the 10% biofuel target

In conclusion the Commission considers the 10 percent obligation does not overly stretch the land availability or lead to a significant increase of intensities of production because of the limited pressure on markets.The long term and relatively small increase in feed use expected in the EU over that time would leave enough possibilities for European farmers to support this new market outlet without a danger of returning to fertilizer and pesticide input patterns seen until the late 1980’s. Farm employment is also expected to decline less than without biofuels, and additional jobs are expected to be created in the downstream activities and processing of biofuel.

References:

European Commission, Directorate-General for Agriculture and Rural Development, Directorate G. Economic analysis, perspectives and evaluations, G.2. Economic analysis of EU agriculture: The impact of a minimum 10% obligation for biofuel use in the EU-27 in 2020 on agricultural markets - Impact assessment Renewable Energy Roadmap [*.pdf], March 2007

Biopact: Highlights from the International Conference on Biofuels (Day 1) -July 05, 2007

Biopact: Sweden calls for the creation of a 'biopact' with the South - Highlights from the International Conference on Biofuels (Day 1, part 2) - July 05, 2007

Biopact: How Brazil convinced the EU on biofuels - Lula's speech - July 06, 2007

--------------

--------------

Scientists, economists and policy experts representing government and public institutions from more than 40 countries will exchange the latest information on economic and technology opportunities at the U.S. Department of Agriculture's "Global Conference on Agricultural Biofuels: Research and Economics", to be held Aug. 20-21 in Minneapolis.

Scientists, economists and policy experts representing government and public institutions from more than 40 countries will exchange the latest information on economic and technology opportunities at the U.S. Department of Agriculture's "Global Conference on Agricultural Biofuels: Research and Economics", to be held Aug. 20-21 in Minneapolis.

0 Comments:

Post a Comment

Links to this post:

Create a Link

<< Home