Study: EU biogas production grew 13.6% in 2006, holds large potential

According to a newly published Energy Barometer on Biogas, the renewable fuel has a large potential in Europe and is growing rapidly amid increasing concerns about oil and gas prices and climate change. In 2006, around 5.35 million tonnes of oil equivalent (mtoe) was produced in the EU, an increase of 13.6% compared to 2005. The production of electricity from biogas grew by 28.9% over the same period. Germany remains European leader and noted a 55.9% growth in 2006 in electricity generated from the renewable gas.

The Biogas Barometer [*.pdf] was produced by a group of renewable energy groups led by Observ’ER as part of the EurObserv’ER projects which monitor the progress of renewable energy development within the Union. It looks at production figures per country, per type of biogas production method and application, and at current policies. The report further shows how European biogas R&D, technologies and services are finding new export opportunities.

Biogas has seen a growing interest in the EU because of the fuel's excellent greenhouse gas emissions and energy balance (earlier post and here). Moreover, biogas is a generic term hiding a wide diversity in both the methods in which it is produced and the ways in which it is valorised. This abundance of potential feedstocks and applications makes it a highly versatile biofuel.

Versatility

Biogas can be either collected directly in landfill sites or produced using digesters. It is possible to transform any type of organic waste into biogas. Effluents are treated in sewage purification plants and household waste in solid waste methanisation units. Slurries, agricultural waste and energy crops can be methanised either in small agricultural units or in large-scale centralised codigestion units (collective units that treat different types of waste associated with a considerable share of slurry).

Valorisation methods vary according to the types of deposit, to methane quality and richness, as well as to market outlets in proximity and policies that are implemented. Rubbish dump biogas, the most abundant deposit, is mainly used to produce electricity that is injected into the power grid. In the case of sewage purification plants (urban and industrial), small agricultural units, centralised co-digestion or solid waste units, CHP (combined heat and power) type production is most often used. In CHP configurations, the production of heat directly contributes to the methanisation process (it serves to keep the digester at a constant temperature). Large size units are also capable of supplying a heat network in the case where commercial outlets exist.

Once it has been purified, biogas can also be used in the form of fuels for vehicles running on natural gas (CNG) (earlier post) or be reinjected into the natural gas distribution network, when this is so permitted by national legislation. Both applications are being undertaken in several member states. Use of the green gas in fuel cells is a recent development (more here).

Production keeps growing

According to the Biogas Barometer, primary energy production of biogas in the EU markedly increased once again in 2006, with 13.6% growth with respect to 2005, i.e. a total production of 5.346 mtoe. This last figure only includes production that is intended to be valorised, and it therefore does not include biogas that is burned in flare stacks.

When it comes to the share of different feedstocks, 'rubbish dump' deposit represents the largest share of production (3.116mtoe). On the other hand, methanisation biogas is no longer represented for the most part by sewage purification plants, the "other biogas" category has moved out in front, in particular thanks to the development of on-farm biogas applications. In terms of final energy, gross electricity production is growing very strongly (+ 28.9%, for a total of 17.3TWh), notably thanks to a strong increase in the electricity produced in CHP systems:

energy :: sustainability :: natural gas :: CNG :: biomass :: bioenergy :: biofuels :: biogas :: biomethane :: European Union ::

energy :: sustainability :: natural gas :: CNG :: biomass :: bioenergy :: biofuels :: biogas :: biomethane :: European Union ::

For the first time, this CHP production exceeds the amount of electricity produced alone. Concerning valorisation in the form of heat, it would be proper to point out that satisfactory monitoring is much more difficult in this case. Statistics generally evaluate the volumes of heat sold, without taking the quantities of heat that could be self-consumed into consideration. According to the Barometer figures, the use of biogas heat progressed very little, + 1% to 631,1 ktoe in 2006:

German success story

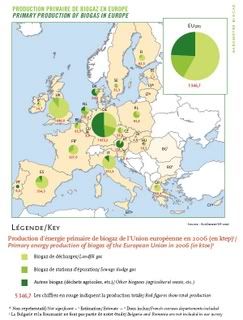

As can be seen on the EU-wide map (click to enlarge), in Germany, the current development of primary energy from biogas is principally made thanks to the production of electricity of small farm methanisation units functioning in combined heat and power (CHP) process. At the end of 2006, approximately 3,500 biogas units were in service. Additional biogas capacity amounted to 550 MWe for the year 2006 alone with about 50 new plants being installed each month.

These investments impact sector electricity production, which, according to the AGEEStat (statistical organisation of the Ministry of the Environment), increased by 55.9% in 2006 (+ 2.6 TWh with respect to 2005) to reach a total of 7.3 TWh.

This success is explained by the application of a particularly attractive feed-in tariff for small biomass electricity production plants (including agricultural biogas). The feed-in tariff, which decreases by 1.5% per year beginning on January 1st 2005, is established in the following manner:

These feed-in tariffs are increased by 2 c€/kWh if the electricity is produced from an innovative technology, like a fuel cell or a gas turbine.

Biogas, a national priority in Sweden

Valorisation of biogas is clearly one of the country’s energy priorities in Sweden. This sector is not only devoted to the production of electricity (54 GWh in 2006) and heat (20.7ktoe), but also to the production of vehicle fuel as well as for reinjection into the natural gas network (replacing the equivalent of 1.8 million m3 of natural gas per year).

There are numerous incentive systems in Sweden promoting the use of biogas. This energy is not subject to the tax on CO2. Moreover, the central government grants subventions to the local governments and to business firms that invest in solutions for reducing greenhouse gas emissions in which biogas plays a role.

There is also a sizeable tax exemption for purchasing vehicles that run on biogas fuel. The production of electricity is supported by a green certificates mechanism.

Codigestion is Danish specialty

In Denmark, the production of biogas comes for the most part from 20 codigestion units and small-scale farm production units (60%), that are far in front of the biogas produced from rubbish dumps (15%) and sewage purification plants (25%). CHP plant biogas has been particularly developed in Denmark and is at the origin of practically all of the biogas electricity produced in the country. Denmark is, moreover, the fourth biggest EU country in terms of biogas if primary energy production per inhabitant, with 17.4 toe per 1 000 inhabitants, is taken into consideration.

ROCs favourable to biogas in UK

In the absence of official figures from the DTI (Department of Trade and Industry), EurObserv’ER has estimated the United Kingdom production level at 1.696 mtoe. This figure would signify that the UK has given up its first place position in terms of primary energy production to Germany. However, the UK holds on as leader if we consider the indicator of primary energy production per inhabitant, with 28.1 toe per 1 000 habitants in the UK vs. 23.3 toe per 1000 inhabitants for Germany.

Growth of primary energy production in the UK is essentially due to an increase in production of electricity from rubbish dump gas. This type of biogas has particularly benefited from the green certificates system, the Renewable Obligation Certificates (ROCs).

The ROC system requires electricity suppliers to increase the renewable electricity share in total production each year.

The obligation level of 6.7% for the 2006/2007 period is going to be progressively increased to 15.4% in 2015. In this system, suppliers can either directly produce the renewable origin electricity themselves or buy certificates from renewable electricity producers. When the objective is not reached, the supplier must pay a fine of £32.33 (€47.22) for each MWh that’s missing. The electricity resulting from biogas from methanisation, rubbish dumps and sewage purification plants is eligible for this system.

3% growth in Italy

According to the first estimates made by the ENEA (Agency for Energy, the Environment and New Technologies), the production of primary energy and of electricity from biogas increased by 3% in Italy in 2006. Biogas plants using vegetal and organic waste are recognised by the GRTN (Italian power grid manager) as being able to participate in the national green certificates system. In the Italian system, producers and importers use these certificates to prove that they have fulfilled their legal obligations to supply a percentage of renewable origin electricity (2.7% in 2006).

The mean price of a green certificate in Italy has been constantly increasing and it reached 13.91 c€/kWh in 2006.

Spain favours electricity production

Electrical power plants running on biomass and biogas benefit from a specific scheme of the Royal Decree 436/2004, which establishes the feed-in tariffs for the different renewable sectors. Operators have a choice between selling their electricity directly on the market or selling it to an electricity distribution company. In this last case, the price set per kWh corresponds to 90% of the reference price of electricity determined each year by Royal Decree.

This tariff is applicable for a period of twenty years and then decreases to 80% of the reference price after this time. If the operators choose the market, they benefit from the market price plus a bonus representing 40% of the set reference price. Furthermore, another subsidy representing 10% of the reference price is added on to their remuneration.

This system has been relatively effective for biogas electricity production with, according to the IDEA (Institute for Energy Diversification and Saving), an 8.8% increase in 2006 with respect to the year before.

Feed-in tariff increase in France

The year 2006 marked a turning point in development of the biogas sector in France with the July publication of new sufficiently attractive tariffs to develop all the different biogas applications. This new tariff is set at between 7.5 and 9 c€/kWh, depending on installation capacity, to which a bonus for energy efficiency going up to 3 c€/kWh is added as well as a 2 c€/kWh prime for methanisation, and this for a period of fifteen years. This tariff should notably make it possible to create an agricultural methanisation sector (on-farm biogas and collective codigestion plants) which is practically inexistent in France today. At the same time, measures have been begun to simplify and make more fluid the technical conditions of access to the power grid.

Biogas electricity production, which only increased by 3.7% in 2006 (501 GWh), according to the Ministry of Industry, should thus rise in power during the next few years.

Industrialists reinforcing themselves

In the space of fifteen years, the waste methanisation industry has structured itself and succeeded in becoming a full-fledged economic sector. Several types of specific methanisation processes have been developed to respond to all of the different demands making up this expanding market.

Supported by their particularly active domestic market, the German actors are naturally among the most present in Europe. Inescapable on the household waste methanisation market, Linde KCA has a complete offer allowing it to propose effective solutions to treat wet or dry organic waste. The firm has already equipped 40 sites and had €160 million turnover in 2006. Several new installations are announced for 2007.

The biggest are planned for in Beijing (73 000 tons of waste treated per year) and in Lille (France), with a 62 000 ton capacity. The French site has the particularity of proposing, in parallel, valorisation in the form of heat (connection to a heat network) and in the form of fuel to supply a part of the municipal bus fleet.

Competitor of the German firm, the Valorga French company has been able over the years to develop and disseminate its house process (which has the same name as the company does).

Today a subsidiary of the Spanish group Urbaser, (the number one waste collection operator in Spain), Valorga has to its credit 19 site references using its technology, with capacities ranging between 10 000 and 300 000 tons of waste treated per year. The company knows how to market itself beyond the European border, since two production sites have been announced for China in 2007. The first, in Shanghai, shall treat 227 500 tons of raw household waste and 41 000 tons of fermentable waste each year. The second in Beijing, of a smaller size, shall convert 105 000 tons of household waste into energy.

Another type of waste and another actor: the German firm Schmack Biogas AG has known how to take very good advantage of the development of agricultural biogas sites, above all on its domestic market. Its turnover went from €34 million to €90 million between 2005 and 2006. Impressive growth that has naturally been reflected in terms of its number of employees as well, which went from 112 to 297 during the same period. Up until now, nearly 180 units have been equipped by Schmack, which is trying more and more to move beyond its borders by concentrating on Italy as well as on the American market.

There are numerous other companies that have developed methanisation processes adapted to all sorts of waste. By way of example, we can cite the Kompogas Swiss company, which equipped 4 new sites in Germany in 2006, the Belgian OWS which has announced a work site in Otaka (Japan) for 2007 and the BTA German company which, armed with its 25 references, is attacking the Japanese market on the Komoro site (70 000 tons of waste per year).

Efforts too late for White paper targets

The current dynamism of the overall sector is favourable overall. Some suggested that over the long term (2020-2030) the European biogas sector can replace all imports of natural gas from Russia (earlier post).

The real efforts made over the last few years by several member countries (United Kingdom, Germany, Denmark, Luxembourg and Sweden) are particularly eloquent with respect to the new sites created. Each of these countries has developed its own channel of valorisation in structuring cutting-edge technologies and industries.

These examples of success and their support mechanisms were able to inspire countries like France. France has in turn set up the conditions necessary for rapid development of its different sectors and notably of its agricultural biogas deposit that has remained practically unexploited up until now.

Within the EU, the potential of production of biogas from this last deposit is doubtless the most considerable. Agricultural biogas also has the advantage of being of excellent quality (rich in methane and poor in pollutants), which facilitates its valorisation.

It is also worth pointing out that the significant increase in the price of conventional energies associated with legislations that are more favourable to the biogas sector, have now opened up the way for energy production based in part on energy crops (notably corn) and not only on waste alone.

The important thing is to correctly balance the economic interests of these solutions with the energy constraints posed by these productions (for example, water consumption).

However, all these efforts, come too late to meet the ambitious objectives that the EU White Paper set in 1997 (15 mtoe in 2010). The Biogas Barometer forecasts, based on the answers received from experts to our questionnaires and on the growth of past years, that a quantity of around 8.6 mtoe can be expected. A low figure that would represent 5.7% of the target of the Biomass Action Plan of the European Commission, which esteems that an energy consumption of all biomass of 150 Mtoe in 2010 is realisable.

The Biogas Barometer was produced by Observ’ER within the framework of the

"EurObserv’ER" project, which unites Observ’ER, Eurec Agency, Erec, Jozef Stefan Institute and Eufores. The programme is financially supported by France's environment agency ADEME and by the Intelligent Energy program of the EU.

References:

EurObserv’ER: Baromètre biogaz - Biogas barometer [*.pdf]- May 2007.

The EurObserv'ER Barometer website.

European Commission: White Paper for a Community Strategy and Action Plan - Energy for the Future: Renewable Sources of Energy [*.pdf] - November 26, 1997.

EurActiv: Biogas has promising future in EU, study shows - July 24, 2007.

The Biogas Barometer [*.pdf] was produced by a group of renewable energy groups led by Observ’ER as part of the EurObserv’ER projects which monitor the progress of renewable energy development within the Union. It looks at production figures per country, per type of biogas production method and application, and at current policies. The report further shows how European biogas R&D, technologies and services are finding new export opportunities.

Biogas has seen a growing interest in the EU because of the fuel's excellent greenhouse gas emissions and energy balance (earlier post and here). Moreover, biogas is a generic term hiding a wide diversity in both the methods in which it is produced and the ways in which it is valorised. This abundance of potential feedstocks and applications makes it a highly versatile biofuel.

Versatility

Biogas can be either collected directly in landfill sites or produced using digesters. It is possible to transform any type of organic waste into biogas. Effluents are treated in sewage purification plants and household waste in solid waste methanisation units. Slurries, agricultural waste and energy crops can be methanised either in small agricultural units or in large-scale centralised codigestion units (collective units that treat different types of waste associated with a considerable share of slurry).

Valorisation methods vary according to the types of deposit, to methane quality and richness, as well as to market outlets in proximity and policies that are implemented. Rubbish dump biogas, the most abundant deposit, is mainly used to produce electricity that is injected into the power grid. In the case of sewage purification plants (urban and industrial), small agricultural units, centralised co-digestion or solid waste units, CHP (combined heat and power) type production is most often used. In CHP configurations, the production of heat directly contributes to the methanisation process (it serves to keep the digester at a constant temperature). Large size units are also capable of supplying a heat network in the case where commercial outlets exist.

Once it has been purified, biogas can also be used in the form of fuels for vehicles running on natural gas (CNG) (earlier post) or be reinjected into the natural gas distribution network, when this is so permitted by national legislation. Both applications are being undertaken in several member states. Use of the green gas in fuel cells is a recent development (more here).

Production keeps growing

According to the Biogas Barometer, primary energy production of biogas in the EU markedly increased once again in 2006, with 13.6% growth with respect to 2005, i.e. a total production of 5.346 mtoe. This last figure only includes production that is intended to be valorised, and it therefore does not include biogas that is burned in flare stacks.

When it comes to the share of different feedstocks, 'rubbish dump' deposit represents the largest share of production (3.116mtoe). On the other hand, methanisation biogas is no longer represented for the most part by sewage purification plants, the "other biogas" category has moved out in front, in particular thanks to the development of on-farm biogas applications. In terms of final energy, gross electricity production is growing very strongly (+ 28.9%, for a total of 17.3TWh), notably thanks to a strong increase in the electricity produced in CHP systems:

energy :: sustainability :: natural gas :: CNG :: biomass :: bioenergy :: biofuels :: biogas :: biomethane :: European Union ::

energy :: sustainability :: natural gas :: CNG :: biomass :: bioenergy :: biofuels :: biogas :: biomethane :: European Union :: For the first time, this CHP production exceeds the amount of electricity produced alone. Concerning valorisation in the form of heat, it would be proper to point out that satisfactory monitoring is much more difficult in this case. Statistics generally evaluate the volumes of heat sold, without taking the quantities of heat that could be self-consumed into consideration. According to the Barometer figures, the use of biogas heat progressed very little, + 1% to 631,1 ktoe in 2006:

German success story

As can be seen on the EU-wide map (click to enlarge), in Germany, the current development of primary energy from biogas is principally made thanks to the production of electricity of small farm methanisation units functioning in combined heat and power (CHP) process. At the end of 2006, approximately 3,500 biogas units were in service. Additional biogas capacity amounted to 550 MWe for the year 2006 alone with about 50 new plants being installed each month.

These investments impact sector electricity production, which, according to the AGEEStat (statistical organisation of the Ministry of the Environment), increased by 55.9% in 2006 (+ 2.6 TWh with respect to 2005) to reach a total of 7.3 TWh.

This success is explained by the application of a particularly attractive feed-in tariff for small biomass electricity production plants (including agricultural biogas). The feed-in tariff, which decreases by 1.5% per year beginning on January 1st 2005, is established in the following manner:

- 17.16 c€/kWh in 2006 (16.99 c€/kWh in 2007) up to 150 kW;

- 15.63 c€/kWh (15.45 c€/kWh in 2007) up to 500 kW;

- 12.64 c€/kWh (12.51 c€/kWh in 2007) up to 5 MW;

- 8.15 c€/kWh (8.03 c€/kWh in 2007) up to 20 MW.

These feed-in tariffs are increased by 2 c€/kWh if the electricity is produced from an innovative technology, like a fuel cell or a gas turbine.

Biogas, a national priority in Sweden

Valorisation of biogas is clearly one of the country’s energy priorities in Sweden. This sector is not only devoted to the production of electricity (54 GWh in 2006) and heat (20.7ktoe), but also to the production of vehicle fuel as well as for reinjection into the natural gas network (replacing the equivalent of 1.8 million m3 of natural gas per year).

There are numerous incentive systems in Sweden promoting the use of biogas. This energy is not subject to the tax on CO2. Moreover, the central government grants subventions to the local governments and to business firms that invest in solutions for reducing greenhouse gas emissions in which biogas plays a role.

There is also a sizeable tax exemption for purchasing vehicles that run on biogas fuel. The production of electricity is supported by a green certificates mechanism.

Codigestion is Danish specialty

In Denmark, the production of biogas comes for the most part from 20 codigestion units and small-scale farm production units (60%), that are far in front of the biogas produced from rubbish dumps (15%) and sewage purification plants (25%). CHP plant biogas has been particularly developed in Denmark and is at the origin of practically all of the biogas electricity produced in the country. Denmark is, moreover, the fourth biggest EU country in terms of biogas if primary energy production per inhabitant, with 17.4 toe per 1 000 inhabitants, is taken into consideration.

ROCs favourable to biogas in UK

In the absence of official figures from the DTI (Department of Trade and Industry), EurObserv’ER has estimated the United Kingdom production level at 1.696 mtoe. This figure would signify that the UK has given up its first place position in terms of primary energy production to Germany. However, the UK holds on as leader if we consider the indicator of primary energy production per inhabitant, with 28.1 toe per 1 000 habitants in the UK vs. 23.3 toe per 1000 inhabitants for Germany.

Growth of primary energy production in the UK is essentially due to an increase in production of electricity from rubbish dump gas. This type of biogas has particularly benefited from the green certificates system, the Renewable Obligation Certificates (ROCs).

The ROC system requires electricity suppliers to increase the renewable electricity share in total production each year.

The obligation level of 6.7% for the 2006/2007 period is going to be progressively increased to 15.4% in 2015. In this system, suppliers can either directly produce the renewable origin electricity themselves or buy certificates from renewable electricity producers. When the objective is not reached, the supplier must pay a fine of £32.33 (€47.22) for each MWh that’s missing. The electricity resulting from biogas from methanisation, rubbish dumps and sewage purification plants is eligible for this system.

3% growth in Italy

According to the first estimates made by the ENEA (Agency for Energy, the Environment and New Technologies), the production of primary energy and of electricity from biogas increased by 3% in Italy in 2006. Biogas plants using vegetal and organic waste are recognised by the GRTN (Italian power grid manager) as being able to participate in the national green certificates system. In the Italian system, producers and importers use these certificates to prove that they have fulfilled their legal obligations to supply a percentage of renewable origin electricity (2.7% in 2006).

The mean price of a green certificate in Italy has been constantly increasing and it reached 13.91 c€/kWh in 2006.

Spain favours electricity production

Electrical power plants running on biomass and biogas benefit from a specific scheme of the Royal Decree 436/2004, which establishes the feed-in tariffs for the different renewable sectors. Operators have a choice between selling their electricity directly on the market or selling it to an electricity distribution company. In this last case, the price set per kWh corresponds to 90% of the reference price of electricity determined each year by Royal Decree.

This tariff is applicable for a period of twenty years and then decreases to 80% of the reference price after this time. If the operators choose the market, they benefit from the market price plus a bonus representing 40% of the set reference price. Furthermore, another subsidy representing 10% of the reference price is added on to their remuneration.

This system has been relatively effective for biogas electricity production with, according to the IDEA (Institute for Energy Diversification and Saving), an 8.8% increase in 2006 with respect to the year before.

Feed-in tariff increase in France

The year 2006 marked a turning point in development of the biogas sector in France with the July publication of new sufficiently attractive tariffs to develop all the different biogas applications. This new tariff is set at between 7.5 and 9 c€/kWh, depending on installation capacity, to which a bonus for energy efficiency going up to 3 c€/kWh is added as well as a 2 c€/kWh prime for methanisation, and this for a period of fifteen years. This tariff should notably make it possible to create an agricultural methanisation sector (on-farm biogas and collective codigestion plants) which is practically inexistent in France today. At the same time, measures have been begun to simplify and make more fluid the technical conditions of access to the power grid.

Biogas electricity production, which only increased by 3.7% in 2006 (501 GWh), according to the Ministry of Industry, should thus rise in power during the next few years.

Industrialists reinforcing themselves

In the space of fifteen years, the waste methanisation industry has structured itself and succeeded in becoming a full-fledged economic sector. Several types of specific methanisation processes have been developed to respond to all of the different demands making up this expanding market.

Supported by their particularly active domestic market, the German actors are naturally among the most present in Europe. Inescapable on the household waste methanisation market, Linde KCA has a complete offer allowing it to propose effective solutions to treat wet or dry organic waste. The firm has already equipped 40 sites and had €160 million turnover in 2006. Several new installations are announced for 2007.

The biggest are planned for in Beijing (73 000 tons of waste treated per year) and in Lille (France), with a 62 000 ton capacity. The French site has the particularity of proposing, in parallel, valorisation in the form of heat (connection to a heat network) and in the form of fuel to supply a part of the municipal bus fleet.

Competitor of the German firm, the Valorga French company has been able over the years to develop and disseminate its house process (which has the same name as the company does).

Today a subsidiary of the Spanish group Urbaser, (the number one waste collection operator in Spain), Valorga has to its credit 19 site references using its technology, with capacities ranging between 10 000 and 300 000 tons of waste treated per year. The company knows how to market itself beyond the European border, since two production sites have been announced for China in 2007. The first, in Shanghai, shall treat 227 500 tons of raw household waste and 41 000 tons of fermentable waste each year. The second in Beijing, of a smaller size, shall convert 105 000 tons of household waste into energy.

Another type of waste and another actor: the German firm Schmack Biogas AG has known how to take very good advantage of the development of agricultural biogas sites, above all on its domestic market. Its turnover went from €34 million to €90 million between 2005 and 2006. Impressive growth that has naturally been reflected in terms of its number of employees as well, which went from 112 to 297 during the same period. Up until now, nearly 180 units have been equipped by Schmack, which is trying more and more to move beyond its borders by concentrating on Italy as well as on the American market.

There are numerous other companies that have developed methanisation processes adapted to all sorts of waste. By way of example, we can cite the Kompogas Swiss company, which equipped 4 new sites in Germany in 2006, the Belgian OWS which has announced a work site in Otaka (Japan) for 2007 and the BTA German company which, armed with its 25 references, is attacking the Japanese market on the Komoro site (70 000 tons of waste per year).

Efforts too late for White paper targets

The current dynamism of the overall sector is favourable overall. Some suggested that over the long term (2020-2030) the European biogas sector can replace all imports of natural gas from Russia (earlier post).

The real efforts made over the last few years by several member countries (United Kingdom, Germany, Denmark, Luxembourg and Sweden) are particularly eloquent with respect to the new sites created. Each of these countries has developed its own channel of valorisation in structuring cutting-edge technologies and industries.

These examples of success and their support mechanisms were able to inspire countries like France. France has in turn set up the conditions necessary for rapid development of its different sectors and notably of its agricultural biogas deposit that has remained practically unexploited up until now.

Within the EU, the potential of production of biogas from this last deposit is doubtless the most considerable. Agricultural biogas also has the advantage of being of excellent quality (rich in methane and poor in pollutants), which facilitates its valorisation.

It is also worth pointing out that the significant increase in the price of conventional energies associated with legislations that are more favourable to the biogas sector, have now opened up the way for energy production based in part on energy crops (notably corn) and not only on waste alone.

The important thing is to correctly balance the economic interests of these solutions with the energy constraints posed by these productions (for example, water consumption).

However, all these efforts, come too late to meet the ambitious objectives that the EU White Paper set in 1997 (15 mtoe in 2010). The Biogas Barometer forecasts, based on the answers received from experts to our questionnaires and on the growth of past years, that a quantity of around 8.6 mtoe can be expected. A low figure that would represent 5.7% of the target of the Biomass Action Plan of the European Commission, which esteems that an energy consumption of all biomass of 150 Mtoe in 2010 is realisable.

The Biogas Barometer was produced by Observ’ER within the framework of the

"EurObserv’ER" project, which unites Observ’ER, Eurec Agency, Erec, Jozef Stefan Institute and Eufores. The programme is financially supported by France's environment agency ADEME and by the Intelligent Energy program of the EU.

References:

EurObserv’ER: Baromètre biogaz - Biogas barometer [*.pdf]- May 2007.

The EurObserv'ER Barometer website.

European Commission: White Paper for a Community Strategy and Action Plan - Energy for the Future: Renewable Sources of Energy [*.pdf] - November 26, 1997.

EurActiv: Biogas has promising future in EU, study shows - July 24, 2007.

--------------

--------------

A Canadian firm, Buchanan Renewable Energies, is to begin an investment into Liberia's biomass industry that will grow to US$20 million in October and offer 300 jobs by end of the year. The company will start shipping 90 major pieces of equipment to Liberia by the end of August.

A Canadian firm, Buchanan Renewable Energies, is to begin an investment into Liberia's biomass industry that will grow to US$20 million in October and offer 300 jobs by end of the year. The company will start shipping 90 major pieces of equipment to Liberia by the end of August.

0 Comments:

Post a Comment

Links to this post:

Create a Link

<< Home