Study: biofuels to supply more than 15% of world's transport fuels by 2030

Market analyst Global Insight, Inc. says in a new study titled The Biofuels Boom: Implications for Automotive, Agriculture & Energy [*.pdf] that more than 100 billion gallons (378.5 billion liters) of bioethanol and biodiesel will be produced globally per year by 2030, an amount equal to more than 15% of the world's road transport fuel needs.

Scenarios

The study runs with two basic scenarios on liquid transport fuels that show dramatically different implications, paths, and consequences for the economy, for biofuel producers and for the automotive industry. The reference case is titled 'Market remanaged' and is based on the idea that OPEC re-emerges as the market ‘governor’. OPEC attempts to manage prices in the low $60/bbl range. The second scenario, titled 'Supply constrained' conceives of a new oil market era, in which the supply-demand balance is based on demand, with supply having difficulties to keep track; price spikes are common and unprecedented oil price levels of more than $100/bbl become a reality.

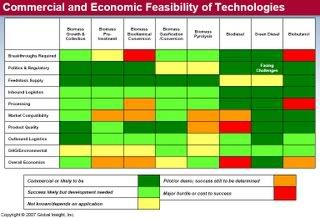

The study analyses the feasibility of bioconversion technologies, by looking at the entire production chain (biomass propagation, growth, harvesting, and collection; biomass pretreatment). The technologies covered are the biochemical route (sugars into ethanol), the thermochemical routes (gasification, pyrolysis), ordinary transesterification and the hydrogenation of vegetable oils to produce 'green diesel'. Biobutanol is covered as well. Table 1 offers an overview of which technologies Global Insight thinks to be commercially and economically feasible over the longer term, and in which state of development they currently are.

Potential supply

Under the different scenarios, biofuels will increase significantly, possibly reaching 15% of the total motor fuel pool world-wide (graph, click to enlarge). Both the EU, the U.S. and Brazil remain leaders.

Under the different scenarios, biofuels will increase significantly, possibly reaching 15% of the total motor fuel pool world-wide (graph, click to enlarge). Both the EU, the U.S. and Brazil remain leaders.

When it comes to biodiesel, the study says that demand and potential supply can be based on non-edible oils such as jatropha, on wood waste, and other non-food products. In Europe, new technologies employing biomass conversion into liquids look promising such as NExBTL developed by Neste. In the U.S. biodiesel demand is expected to reach around 5 billion gallons (18.9 bn liters) by 2030, whereas in the EU it will stand at around 7 bn gallons (26.5 bn liters) by then. The EU has a supply gap and will have to rely on imported feedstocks (graph, click to enlarge).

When it comes to biodiesel, the study says that demand and potential supply can be based on non-edible oils such as jatropha, on wood waste, and other non-food products. In Europe, new technologies employing biomass conversion into liquids look promising such as NExBTL developed by Neste. In the U.S. biodiesel demand is expected to reach around 5 billion gallons (18.9 bn liters) by 2030, whereas in the EU it will stand at around 7 bn gallons (26.5 bn liters) by then. The EU has a supply gap and will have to rely on imported feedstocks (graph, click to enlarge).

U.S. growth in bioethanol will continue to come mainly from corn, and is projected to reach 15 bn gallons by 2015 (about 1 million barrels per day) and a whopping 60 bn gallons by 2030. In the EU demand is expected to reach slightly less than 3.5 bn gallons (13.2 bn liters) by 2030, but growth will be again be limited by local supply constraints and must rely on imports from Africa and South America (graph, click to enlarge). We think the projection for U.S. production of ethanol is slightly unrealistic, especially given the much higher commercial feasibility of producing the fuel in the South.

U.S. growth in bioethanol will continue to come mainly from corn, and is projected to reach 15 bn gallons by 2015 (about 1 million barrels per day) and a whopping 60 bn gallons by 2030. In the EU demand is expected to reach slightly less than 3.5 bn gallons (13.2 bn liters) by 2030, but growth will be again be limited by local supply constraints and must rely on imports from Africa and South America (graph, click to enlarge). We think the projection for U.S. production of ethanol is slightly unrealistic, especially given the much higher commercial feasibility of producing the fuel in the South.

Implications for the Automotive Industry

Based on a survey of automotive manufacturers and analyses by Global Insight’s Automotive Group, the report shows what are the possible consequences of the biofuels boom for automotive manufacturers:

energy :: sustainability :: ethanol :: biodiesel :: biobutanol :: biomass :: bioenergy :: biofuels :: oil ::

energy :: sustainability :: ethanol :: biodiesel :: biobutanol :: biomass :: bioenergy :: biofuels :: oil ::

'Market remanaged' scenario

For the U.S., the situation looks as follows:

'Market remanaged' scenario

Implications for hybrid vehicles

The study finds that hybrid vehicles are introduced across all major (high volume) model lines, and hybrid diesels are introduced. As the cost of hybrid components decreases, the diesel-hybrid combination becomes attractive as a market differentiator.

Diesels will continue to play a significant role in EU

In 2008 diesel cars trend at 50–60% share of the new car fleet, in 2009 diesel hybrids enter the market as mechanism for meeting fuel efficiency CO2 emissions targets. By 2015 diesel vehicles take 65% of the new light duty vehicle fleet, whereas by 2030 diesels are expected to make up 35% of light duty vehicle fleet and at least 25% of the on-road fleet.

The study was conducted by Global Insight's Agriculture, Automotive and Energy Groups who worked with some 20 companies and organizations representing different perspectives of the biofuels industry. The Global Insight study was released at a conference in Monaco sponsored by the Foundation Prince Albert II de Monaco.

References:

Global Insight: The Biofuels Boom: Implications for Agriculture, Energy, and Automotive - [*.pdf], detailed presentation - July 2007.

Global Insight: The Biofuels Boom: Implications for Agriculture, Energy, and Automotive, study page.

Scenarios

The study runs with two basic scenarios on liquid transport fuels that show dramatically different implications, paths, and consequences for the economy, for biofuel producers and for the automotive industry. The reference case is titled 'Market remanaged' and is based on the idea that OPEC re-emerges as the market ‘governor’. OPEC attempts to manage prices in the low $60/bbl range. The second scenario, titled 'Supply constrained' conceives of a new oil market era, in which the supply-demand balance is based on demand, with supply having difficulties to keep track; price spikes are common and unprecedented oil price levels of more than $100/bbl become a reality.

The study analyses the feasibility of bioconversion technologies, by looking at the entire production chain (biomass propagation, growth, harvesting, and collection; biomass pretreatment). The technologies covered are the biochemical route (sugars into ethanol), the thermochemical routes (gasification, pyrolysis), ordinary transesterification and the hydrogenation of vegetable oils to produce 'green diesel'. Biobutanol is covered as well. Table 1 offers an overview of which technologies Global Insight thinks to be commercially and economically feasible over the longer term, and in which state of development they currently are.

Potential supply

Under the different scenarios, biofuels will increase significantly, possibly reaching 15% of the total motor fuel pool world-wide (graph, click to enlarge). Both the EU, the U.S. and Brazil remain leaders.

Under the different scenarios, biofuels will increase significantly, possibly reaching 15% of the total motor fuel pool world-wide (graph, click to enlarge). Both the EU, the U.S. and Brazil remain leaders.- The United States could reach 35% of on-road petroleum demand — in the same range as Brazil

- Biomass producers will be in an advantageous position to produce renewable fuel feedstocks

- The move will affect oil and gas producers in the United States and Canada by shifting away from petroleum-based fuels

When it comes to biodiesel, the study says that demand and potential supply can be based on non-edible oils such as jatropha, on wood waste, and other non-food products. In Europe, new technologies employing biomass conversion into liquids look promising such as NExBTL developed by Neste. In the U.S. biodiesel demand is expected to reach around 5 billion gallons (18.9 bn liters) by 2030, whereas in the EU it will stand at around 7 bn gallons (26.5 bn liters) by then. The EU has a supply gap and will have to rely on imported feedstocks (graph, click to enlarge).

When it comes to biodiesel, the study says that demand and potential supply can be based on non-edible oils such as jatropha, on wood waste, and other non-food products. In Europe, new technologies employing biomass conversion into liquids look promising such as NExBTL developed by Neste. In the U.S. biodiesel demand is expected to reach around 5 billion gallons (18.9 bn liters) by 2030, whereas in the EU it will stand at around 7 bn gallons (26.5 bn liters) by then. The EU has a supply gap and will have to rely on imported feedstocks (graph, click to enlarge). U.S. growth in bioethanol will continue to come mainly from corn, and is projected to reach 15 bn gallons by 2015 (about 1 million barrels per day) and a whopping 60 bn gallons by 2030. In the EU demand is expected to reach slightly less than 3.5 bn gallons (13.2 bn liters) by 2030, but growth will be again be limited by local supply constraints and must rely on imports from Africa and South America (graph, click to enlarge). We think the projection for U.S. production of ethanol is slightly unrealistic, especially given the much higher commercial feasibility of producing the fuel in the South.

U.S. growth in bioethanol will continue to come mainly from corn, and is projected to reach 15 bn gallons by 2015 (about 1 million barrels per day) and a whopping 60 bn gallons by 2030. In the EU demand is expected to reach slightly less than 3.5 bn gallons (13.2 bn liters) by 2030, but growth will be again be limited by local supply constraints and must rely on imports from Africa and South America (graph, click to enlarge). We think the projection for U.S. production of ethanol is slightly unrealistic, especially given the much higher commercial feasibility of producing the fuel in the South.Implications for the Automotive Industry

Based on a survey of automotive manufacturers and analyses by Global Insight’s Automotive Group, the report shows what are the possible consequences of the biofuels boom for automotive manufacturers:

- High volumes of biofuels in the United States will almost certainly require flex-fuel vehicles (FFVs) capable of running on blends up to 85% ethanol (E85)

- In Europe, ethanol content is held for most countries to 10% (E10), which is technically compatible in current vehicles

- Biodiesel levels of 5% (B5) are possible in virtually all vehicles, and new vehicles can be developed to accept blends up to 30% (B30)

- Technical fixes to meet higher biofuels levels are known, but will add some costs to vehicles

energy :: sustainability :: ethanol :: biodiesel :: biobutanol :: biomass :: bioenergy :: biofuels :: oil ::

energy :: sustainability :: ethanol :: biodiesel :: biobutanol :: biomass :: bioenergy :: biofuels :: oil :: 'Market remanaged' scenario

- 2012: EU standard of 130 g/km CO2 emissions (without biofuels benefit) could be met

- 2018: EU new vehicle CO2 emissions reach 120 g/km (without renewable fuel credit) and holds at this level to the end of the period

- 2012: EU standard of 130 g/km CO2 emissions (without biofuels benefit) could be met

- 2018: EU new vehicle CO2 emissions reach 120 g/km

- 2025: EU new car efficiency is 90 g/km CO2

For the U.S., the situation looks as follows:

'Market remanaged' scenario

- 2018: New vehicle fleet fuel economy reaches 32 mpg (193 g/km CO2), but there is much uncertainty

- 2030: New vehicle fleet fuel economy reaches 48 mpg (128 g/km CO2), but there is much uncertainty

- 2020: New vehicle fleet fuel economy reaches 45 mpg (137 g/km CO2), but there is much uncertainty; requires 60% hybridization in the United States

- 2030: New vehicle fleet fuel economy reaches 53 mpg (117 g/km CO2), but there is much uncertainty

Implications for hybrid vehicles

The study finds that hybrid vehicles are introduced across all major (high volume) model lines, and hybrid diesels are introduced. As the cost of hybrid components decreases, the diesel-hybrid combination becomes attractive as a market differentiator.

Diesels will continue to play a significant role in EU

In 2008 diesel cars trend at 50–60% share of the new car fleet, in 2009 diesel hybrids enter the market as mechanism for meeting fuel efficiency CO2 emissions targets. By 2015 diesel vehicles take 65% of the new light duty vehicle fleet, whereas by 2030 diesels are expected to make up 35% of light duty vehicle fleet and at least 25% of the on-road fleet.

The study was conducted by Global Insight's Agriculture, Automotive and Energy Groups who worked with some 20 companies and organizations representing different perspectives of the biofuels industry. The Global Insight study was released at a conference in Monaco sponsored by the Foundation Prince Albert II de Monaco.

References:

Global Insight: The Biofuels Boom: Implications for Agriculture, Energy, and Automotive - [*.pdf], detailed presentation - July 2007.

Global Insight: The Biofuels Boom: Implications for Agriculture, Energy, and Automotive, study page.

--------------

--------------

Spanish engineering and energy company Abengoa says it had suspended bioethanol production at the biggest of its three Spanish plants because it was unprofitable. It cited high grain prices and uncertainty about the national market for ethanol. Earlier this year, the plant, located in Salamanca, ceased production for similar reasons. To Biopact this is yet another indication that biofuel production in the EU/US does not make sense and must be relocated to the Global South, where the biofuel can be produced competitively and sustainably, without relying on food crops.

Spanish engineering and energy company Abengoa says it had suspended bioethanol production at the biggest of its three Spanish plants because it was unprofitable. It cited high grain prices and uncertainty about the national market for ethanol. Earlier this year, the plant, located in Salamanca, ceased production for similar reasons. To Biopact this is yet another indication that biofuel production in the EU/US does not make sense and must be relocated to the Global South, where the biofuel can be produced competitively and sustainably, without relying on food crops.

1 Comments:

Very interesting study on Biofuels and its environmental and economical implications.

I am using it as a source of information for my Graduation Thesis about Ethanol's Regulation in Brazil as a Key for its International Commerce Expansion.

Post a Comment

Links to this post:

Create a Link

<< Home