Food import bills reach a record high, biofuels partly to blame

Global food import bills are increasing, partly due to soaring demand for biofuels, according to FAO’s latest Food Outlook report. Global expenditures on imported foodstuffs look set to surpass US$400 billion in 2007, almost 5 percent above the record of the previous year.

Global food import bills are increasing, partly due to soaring demand for biofuels, according to FAO’s latest Food Outlook report. Global expenditures on imported foodstuffs look set to surpass US$400 billion in 2007, almost 5 percent above the record of the previous year.The data once again immediately bring up the issue of global trade regimes and agricultural subsidies. Countries with a very large food production potential - like the DRCongo, Mozambique or Angola - are net food importers.

To the dismay of development economists and civil society organisations alike, farm subsidies in the EU and the US prevent investments in domestic food production in these countries. Their dependence on imported food means they are vulnerable to global price fluctuations that are beginning to be influenced by (subsidised) biofuels. For net exporters, the price increases are a blessing.

Over the long term, the FAO said earlier, biofuels can fundamentally boost food production and help alleviate poverty (earlier post).

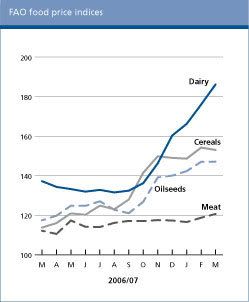

The FAO's latest Food Outlook notes that rising prices of imported coarse grains and vegetable oils – the commodity groups that feature most heavily in biofuel production – account for the bulk of the increase. Import bills for these commodities are forecast to rise by as much as 13 percent from 2006, the report said.

Contrary to other reports, the report states that more expensive feed ingredients will lead to higher prices for meat and dairy products, raising expenditures on imports of those commodities. In several cases, such as for meat and rice, larger world purchases are likely to drive import bills up.

In the case of sugar, generally high and volatile prices could lead to smaller import volumes, which is likely to result in a drop in the cost of global sugar imports, the report said.

Record-high international freight rates have also affected the import value of all commodities, putting additional pressure on countries’ abilities to cover their food import bills:

biofuels :: energy :: sustainability :: ethanol :: biodiesel :: oilseeds :: grain :: meat :: sugar :: agriculture :: food :: subsidies :: FAO ::

biofuels :: energy :: sustainability :: ethanol :: biodiesel :: oilseeds :: grain :: meat :: sugar :: agriculture :: food :: subsidies :: FAO :: Poor pay more

Developing countries as a whole are anticipated to face a 9 percent increase in overall food import expenditures in 2007. The more economically vulnerable countries are forecast to be most affected, with total expenditures by low-income food-deficit (LIFDC) and least developed countries (LDCs) expected to rise by 10 percent from last year.

“The food import basket for the least developed countries in 2007 is expected to cost roughly 90 percent more than it did in 2000,” said FAO economist Adam Prakash. “This is in stark contrast to the 22 percent growth in developed country import bills over the same period.”

Production up, but so is demand

World cereal production in 2007 is forecast to reach 2125 million tonnes, up 6 percent from the reduced level in 2006 and higher than FAO’s previous forecast in May.

"The prospect of a strong recovery in global cereal production in 2007 is a positive development, but total supplies will still be barely adequate to meet the expected rise in demand, not only from the traditional food and feed sectors but in particular from the fast-growing biofuels industry," said Abdolreza Abbassian, one of the authors of the report. "This means prices for most cereals are likely to remain high in the coming year."

FAO’s tentative forecast for rice production this year stands at around 633 million tonnes, matching last year’s record level, but with production still running short of consumption. Global rice reserves are forecast to shrink and higher price levels are anticipated.

Global cassava production in 2007 could surpass last year’s record level, due largely to measures to increase utilization of the crop in the larger producing countries, especially for industrial usage, including ethanol production.

Oilseeds

Oilseeds and meal prices have continued to rise, largely due to surging feed grain prices. Unusually high maize prices are dragging up soybean prices as the two commodities are competing in both the feed and energy markets. First forecasts for the 2007/08 marketing season suggest that the steady growth in global oilseed production could come to a halt, however, as maize cultivation is likely to expand at the expense of soybeans.

Meat and dairy

Increased consumer confidence, following a reduced incidence of animal disease outbreaks in the past year, should result in a recovery in meat demand in developing countries in 2007, the report said. Global meat exports are anticipated to increase by 3.8 percent as trade bans are gradually lifted and markets return to more normal patterns.

Poultry prices have recovered after declining by 18 percent in early 2006, mainly because of outbreaks of avian influenza. By March 2007, export prices in the United States and Brazil, which together supply 70 percent of global trade, increased by 20 percent and 14 percent, respectively, from their 2006 annual averages.

FAO’s meat price index has significantly recovered from a low in 2006 and, in March 2007, stood 7.6 percent higher than in March 2006. Moreover, rising feed prices are putting further upward pressure on meat prices, according to the report.

Prices of dairy products are currently at historically high levels. The FAO price index of traded dairy products has risen by 46 percent since November 2006. International prices for milk powders have increased most, as stocks in the European Union have disappeared.

The outlook for 2007 is for stronger growth in global milk supply, which may increase by 2.7 percent, sustained largely by expansion in those countries more responsive to international prices. Drought in Australia, suspension of milk powder exports by India, and Argentina’s export taxes are restraining export supply in the short term. However, EU dairy policy reform is changing the structure of international markets as its export market share declines, creating opportunities for emerging exporters, the report said.

--------------

--------------

Japan's Itochu Corp will team up with Brazilian state-run oil firm Petroleo Brasileiro SA to produce sugar cane-based bioethanol for biofuels, with plans to start exporting the biofuel to Japan around 2010. Itochu and Petrobras will grow sugarcane as well as build five to seven refineries in the northeastern state of Pernambuco. The two aim to produce 270 million liters (71.3 million gallons) of bioethanol a year, and target sales of around 130 billion yen (€800million / US$1billion) from exports of the products to Japan.

Japan's Itochu Corp will team up with Brazilian state-run oil firm Petroleo Brasileiro SA to produce sugar cane-based bioethanol for biofuels, with plans to start exporting the biofuel to Japan around 2010. Itochu and Petrobras will grow sugarcane as well as build five to seven refineries in the northeastern state of Pernambuco. The two aim to produce 270 million liters (71.3 million gallons) of bioethanol a year, and target sales of around 130 billion yen (€800million / US$1billion) from exports of the products to Japan.

0 Comments:

Post a Comment

Links to this post:

Create a Link

<< Home