D1 Oils and BP to establish global joint venture to plant jatropha

In an important step for the production of biofuels in the Global South, D1 Oils plc, the UK-based producer of biodiesel, announced [*.pdf] plans to establish a global Joint Venture with BP to create a world-wide Jatropha curcas plantation business: D1-BP Fuel Crops Limited. The humble shrub's oil ('crude jatropha oil' - CJO) is now on track to become a commodity that can be produced by countless farmers in the developing world.

In an important step for the production of biofuels in the Global South, D1 Oils plc, the UK-based producer of biodiesel, announced [*.pdf] plans to establish a global Joint Venture with BP to create a world-wide Jatropha curcas plantation business: D1-BP Fuel Crops Limited. The humble shrub's oil ('crude jatropha oil' - CJO) is now on track to become a commodity that can be produced by countless farmers in the developing world.Jatropha is an oilseed tree that grows in tropical and sub-tropical regions and produces high yields of inedible vegetable oil that can be used to produce high-quality biodiesel. Jatropha can grow on a wide range of land types, including non-arable, marginal and waste land. Jatropha does not compete with food crops for good agricultural land or result in the destruction of rainforest.

The establishment of the 50:50 JV to undertake global planting of jatropha has the following aims and features:

- An accelerated planting programme: a target to plant one million hectares over four years; in the first year of the JV's operation the pace of planting is likely to remain at the current 150,000 hectares per annum target; it is expected to increase thereafter up to a targeted rate of at least 350,000 hectares per annum by the fourth year.

- More rapid deployment of higher yielding jatropha varieties: all of D1 oils' current plantations are based on uncultivated “wild seed” jatropha which yield around 1.7 tons/hectare, the JV will allow the deployment of elite E1 seeds with an estimated yield of 2.7 tonnes per hectare

- Development of logistics strategy and a global supply chain

- Initial contribution of parties: D1 planting to date and planting business, BP working capital of £31.75 million through equity in the JV; total JV funding requirement of approximately £80 million over five years

- Plant science activities and intellectual property remain 100 per cent owned by D1

bioenergy :: biofuels :: energy :: sustainability :: biodiesel :: jatropha :: plantations :: rural development :: Asia :: Africa ::

bioenergy :: biofuels :: energy :: sustainability :: biodiesel :: jatropha :: plantations :: rural development :: Asia :: Africa :: Under the terms of the Joint Venture Agreement signed today D1 and BP will work together exclusively on the development of jatropha as a sustainable energy crop, including the planting of trees, harvesting jatropha grain, oil extraction and transport and logistics. Production of jatropha oil for refining into biodiesel is expected to begin in 2008.

D1 Oils Plant Science Limited, D1’s plant science business, will act as the exclusive supplier of selected, high yielding jatropha seeds and seedlings to the Joint Venture. The strategy sees it planting elite seed in greater quantities than D1’s stand alone plan.

With the conclusion of this transaction D1 will comprise, in its upstream business, its wholly owned plant science operations together with the IP in plant science, in addition to 50 per cent of a global planting joint venture with BP. In its downstream operations, the business will include, as it does now, its wholly owned interests in refining and trading.

Commenting on the announcement, Lord Oxburgh of Liverpool, Chairman of D1 Oils

plc said: "Biodiesel is a young industry, but is rapidly becoming an established part of the global renewable energy landscape. It is crucial that we develop supplies of alternative, inedible vegetable oils like jatropha that are not subject to the same demand pressures as food oils and that are grown on non-essential land. This partnership with BP strengthens D1’s strategy of delivering commercial volumes of jatropha oil at competitive prices, whilst truly supporting the communities in which we operate."

Elliott Mannis, Chief Executive Officer of D1 Oils plc, said: “This is a transforming event for D1. BP’s decision to join us in this new venture is a significant endorsement of our strategy to develop jatropha for the production of sustainable biodiesel. It shows we have come a long way. BP’s proven logistical, managerial and financial support will enable a significant enhancement and acceleration of the scope and pace of jatropha planting.”

Philip New, Head of BP Biofuels, said:

"As jatropha can be grown on land of lesser agricultural value with lower irrigation requirements than many plants, it is an excellent biodiesel feedstock. D1 Oils’ progress in identifying the most productive varieties of jatropha means that the joint venture will have access to seeds which can substantially increase jatropha oil production per hectare.”

Reasons for the Joint Venture and Strategy

BP plc has a market capitalisation of approximately £114.6 billion. The combination of both financial and industrial strength make it a partner with considerable credibility internationally to assist D1 in the next stages of its corporate development. It is proposed that the JV will be established between D1 and BP International, a subsidiary of BP plc. BP International, which is based in the UK, is engaged internationally in oil, petrochemicals and related financial activities.

The combination of BP’s strong brand and reputation, its major presence in downstream transportation fuel markets, its strong understanding of associated technical and regulatory issues and demand drivers, its access to governments, NGOs and other large organisations and its trading and logistics expertise, make it an attractive partner for D1.

It will also contribute to the development of a world leading player in jatropha. D1 Oils says the JV will have a beneficial impact on:

• Plantation management and Crude Jatropha Oil (“CJO”) production

• Plant science and seedling production

• The wider D1 group

Plantation management and CJO production

D1 has established a leading position globally in the commercialisation of jatropha as a biofuels crop. Jatropha can grow on a wide range of land types, including non-arable, marginal and waste land. It will not compete with food crops for good agricultural land or result in the destruction of rainforest. D1 is on track to deliver on the objectives for its Agronomy business as identified at the time of D1’s most recent placing in December 2006.

The JV will adopt a business plan which the D1 Board believes significantly exceeds D1’s standalone plan in terms of scale and quality and that the involvement of BP with its competencies and resources will increase the likelihood of a successful implementation of the plan. The key features of the Joint Venture business plan are:

• An accelerated planting programme.

The JV business plan is to target 1.0 million hectares of new commercial jatropha cultivation over the next four years compared to approximately 600,000 hectares on a standalone basis. In the first year of the JV the pace of planting is likely to remain at the current 150,000 hectares per annum target. However, the pace of planting is expected to increase thereafter up to a targeted rate of at least 350,000 hectares per annum by the fourth year.

• A higher quality planting programme.

D1 has to date focused on contract farming and seed purchase agreements. These planting methods are less capital intensive and better reflect D1’s financial resources. The arrangements have facilitated the roll-out of D1’s vertically integrated jatropha based strategy but are limited by: the use of lower yielding wild seed; wide variations in land quality and agricultural techniques and the substantial number of partners spread across a wide geography.

The JV’s planting is intended to be much more strongly weighted towards managed plantations where the JV owns and/or controls the land and production, and towards local partners of significant scale and depth. This is a more capital intensive approach than has been hitherto used by D1 to expand the business, but will result in more reliable oil flow to the Joint Venture than some of D1’s existing contract farming and seed supply relationships.

Forming the JV will facilitate this strategy, partly because BP will help with the extra funding implied by the extra capital intensity, and partly because BP’s reputation and standing are likely to help attract high quality partners.

• More rapid deployment of higher yielding jatropha varieties.

All planting to date has been undertaken using uncultivated “wild seed” which D1 believes will yield 1.7 tonnes per hectare from mature, well managed plantations. The JV will focus on the deployment of elite E1 seeds, targeting yields of 2.7 tonnes per hectare as rapidly as is practicable and at a faster rate than under D1’s standalone business plan. In due course subsequent generations of proprietary seed with increased yields and / or improved characteristics will be utilised.

DOPSL, D1’s new plant breeding and seedling production company, remains outside the JV and will be an exclusive provider of elite planting material and will produce more elite seedlings than under the standalone plan. This is possible because the planting programme will be both larger, and will comprise a higher proportion of land where the commercial relationship is strong enough to merit the deployment of elite seed.

Furthermore, under the terms of the proposed arrangement, the increase of DOPSL’s production capability will be fully paid for by the JV, even though DOPSL itself remains a wholly-owned subsidiary of D1.

• Development of logistics strategy and a global supply chain.

As well as offering the opportunity for greater levels of planting and at higher yields, the formation of the JV will assist with establishing a full, vertically integrated supply chain taking harvested seeds through crushing and pre-processing, and then delivering CJO both to domestic and export customers. BP brings very considerable expertise in establishing and managing operations and supply chains on a global basis and the D1 Board believes that the Joint Venture will draw significant benefit from BP’s experience in this field.

• Use of BP network and brand.

BP has a strong presence and reputation in almost all of the countries where the JV will be operating. The JV will capitalise on this in its dealings with government and regulatory agencies, NGOs and current or potential partners. In addition to lending its name to the Joint Venture, BP plc has provided a royalty-free licence agreement allowing the JV to use the BP “helios” trademark on its communications materials.

• Enhanced funding for D1 and leverage for its shareholders.

The capital required by the JV is to increase the scope and pace of planting activities, focus on the deployment of elite seed, finance a significant increase in DOPSL’s production capacity, and develop an optimal logistics strategy. Of this BP will be responsible for funding the first £31.75m of working capital. These monies are expected to be drawn down over the next two years, thus providing a cash flow benefit to D1 relative to its standalone plan. Beyond this, D1 and BP will be jointly responsible for funding the Joint Venture on a basis pro rata to their shareholdings. The JV is also able to raise further funds in the debt capital markets.

Plant science and seedling production

D1’s plant science and seedling production business will be transferred into DOPSL, which will remain a wholly-owned subsidiary of D1. The formation of DOPSL establishes D1’s existing plant science and seedling production business as a discrete stand-alone entity with its own dedicated team. This will enable DOPSL to maintain its focus on research and development, and to provide the framework by which it can increasingly contribute to the D1 group. DOPSL’s production costs will be fully funded by the Joint Venture.

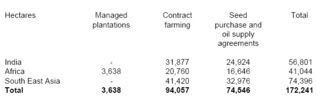

As at 23 June 2007, D1 had planted or obtained rights to offtake over approximately 172,000 hectares as summarised in the table below:

D1’s effective economic interest in the above planting after taking into account the interests of its partners is approximately 50 per cent.

Shares of D1 went up 10% today.

References:

D1: Analyst presentation D1-BP Fuel Crops Limited [*.pdf]

Biopact: D1 Oils has planted over 156,000 hectares of jatropha - May 03, 2007

--------------

--------------

Siemens Energy & Automation, Inc. and the U.S. National Corn-to-Ethanol Research Center (NCERC) today announced a partnership to speed the growth of alternative fuel technology. The 10-year agreement between the center and Siemens represents transfers of equipment, software and on-site simulation training. The NCERC facilitates the commercialization of new technologies for producing ethanol more effectively and plays a key role in the Bio-Fuels Industry for Workforce Training to assist in the growing need for qualified personnel to operate and manage bio-fuel refineries across the country.

Siemens Energy & Automation, Inc. and the U.S. National Corn-to-Ethanol Research Center (NCERC) today announced a partnership to speed the growth of alternative fuel technology. The 10-year agreement between the center and Siemens represents transfers of equipment, software and on-site simulation training. The NCERC facilitates the commercialization of new technologies for producing ethanol more effectively and plays a key role in the Bio-Fuels Industry for Workforce Training to assist in the growing need for qualified personnel to operate and manage bio-fuel refineries across the country.

0 Comments:

Post a Comment

Links to this post:

Create a Link

<< Home